Stocks rally on euphoria over US trade deal

By Muhammad Kashif

2025-08-01

KARACHI: A trade agreement with the United States helped keep Pakistan stocks in bullish territory on Thursday, despite the central bank`s unexpected decision to maintain the policy rate.

Investor confidence surged, driving the benchmark KSE-100 index back above the 139,000-mark on the back of value-hunting and strong macroeconomic cues.

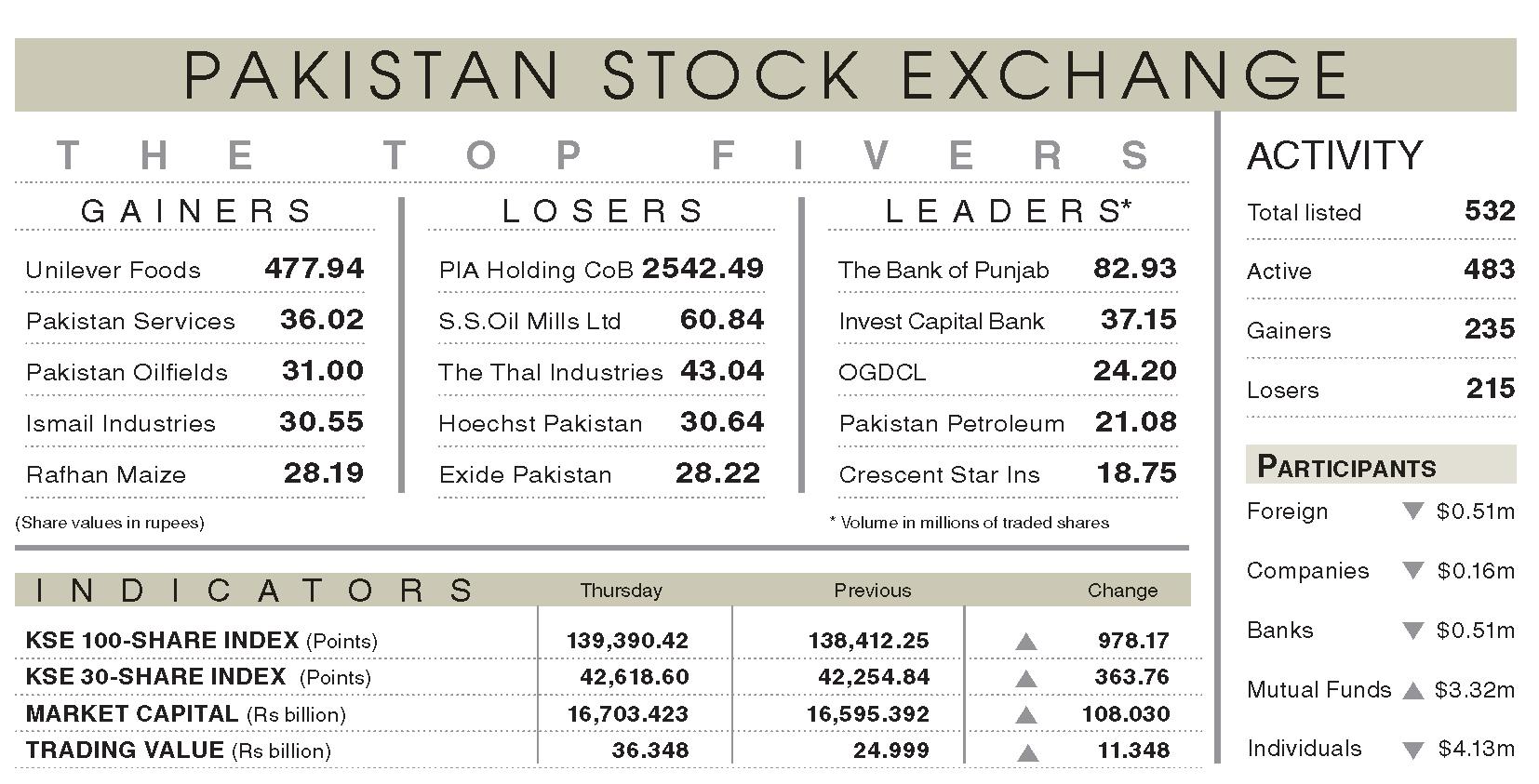

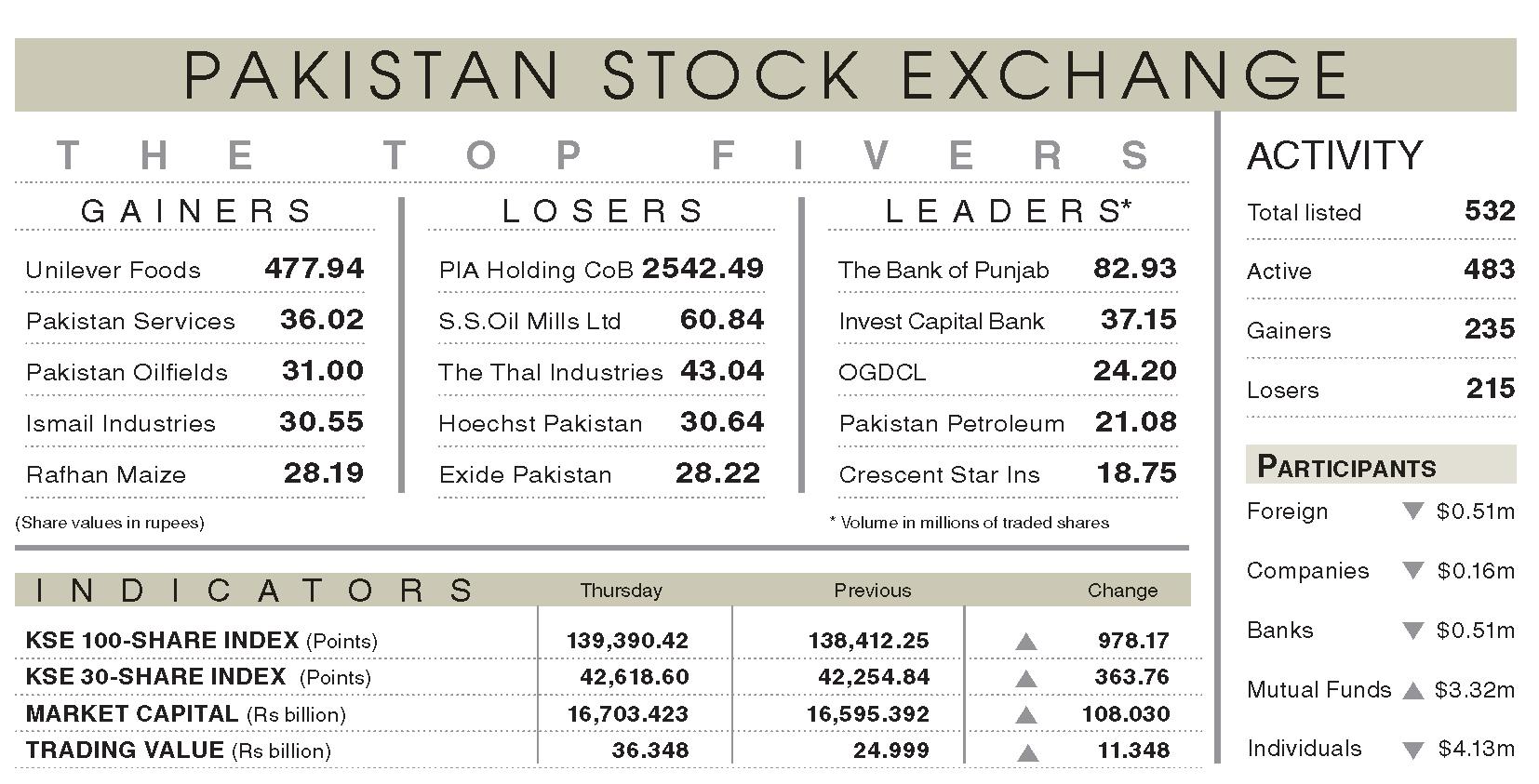

Topline Securities Ltd reported that the bulls dominated July, with the KSE-100 index rising 11pc month-on-month to a record close of 139,390 points. The rally was underpinned by the federal cabinet`s approval of Pakistan`s largest-ever financial restructuring plan, aimed at retiring Rs1.275tr in circular debt over six years. The State Bank of Pakistan`s decision to maintain interestrates further bolstered investor sentiment.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, noted that the market experienced sharp swings following the SBP`s statusquo policy stance. The index climbed to an intraday high of 140,215 points up 1,802 points or 1.30pc before retreating to a low of 139,084 points. It ultimately set-tled at 139,390, posting a net gain of 978 points or 0.71pc.

The early rally was sparked by a surprise social media post from US President Donald Trump,alluding to a potential Pakistan-US partnership in oil exploration. The energy sector reacted strongly, with key movers including Systems Ltd, Oil and Gas Developmentalluding to a potential Pakistan-US partnership in oil exploration. The energy sector reacted strongly, with key movers including Systems Ltd, Oil and Gas DevelopmentCompany, Pakistan Oilfields, Mari Petroleum, and Pakistan Petroleum, which collectively added 824 pointsto theindex.In contrast, Fauji Fertiliser, Bank Alfalah, Engro Fertiliser, Habib Bank, and Ghani Glass dragged the index down by 311 points.

Ahsan Mehanti of Arif Habib Corporation said the market closed on a bullish note following the US-Pakistan trade agreement, which reaffirmed cooperation on large-scale oil reserves. He added that rupee stability and a sharp rally in Pakistan`s sovereign bonds, driven by a recent S&P credit rating upgrade, acted as additional catalysts.

Trading activity was robust, with total volume rising 35.77pc to 577.34 million shares and traded value increasing 45.39pc to Rs36bn. Bank of Punjab led the volumes chart, with 82.93 million shares traded.