PSX surges past 141,000-point milestone

By Muhammad Kashif

2025-08-02

KARACHI: Pakistan`s stock market surged to an all-time high on Friday, with the benchmark KSE100 index breaching the 141,000 mark for the first time, fuelled by optimism over a landmark tariff deal with the United States and expectations of a resolution to the circular debt crisis.

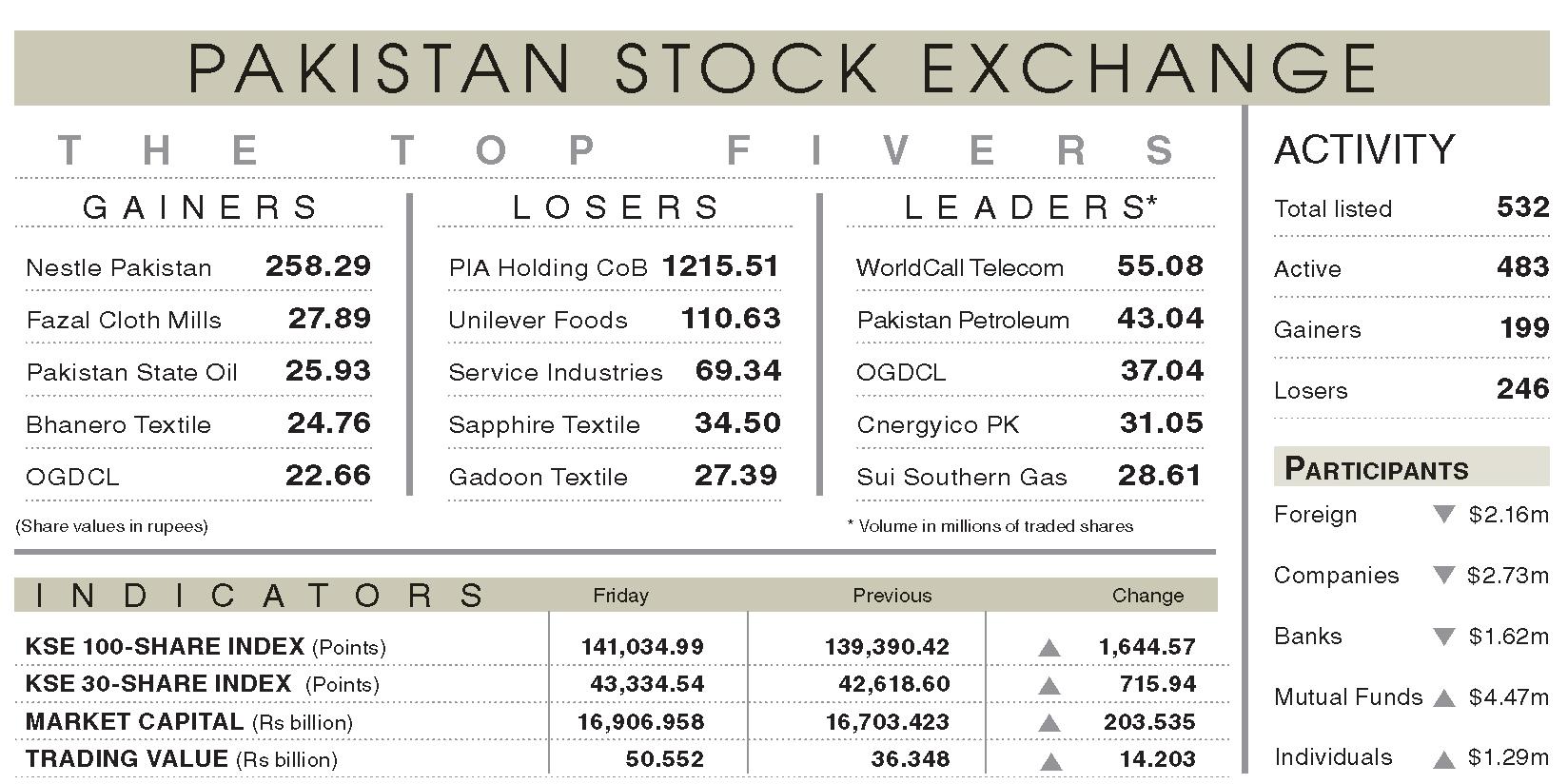

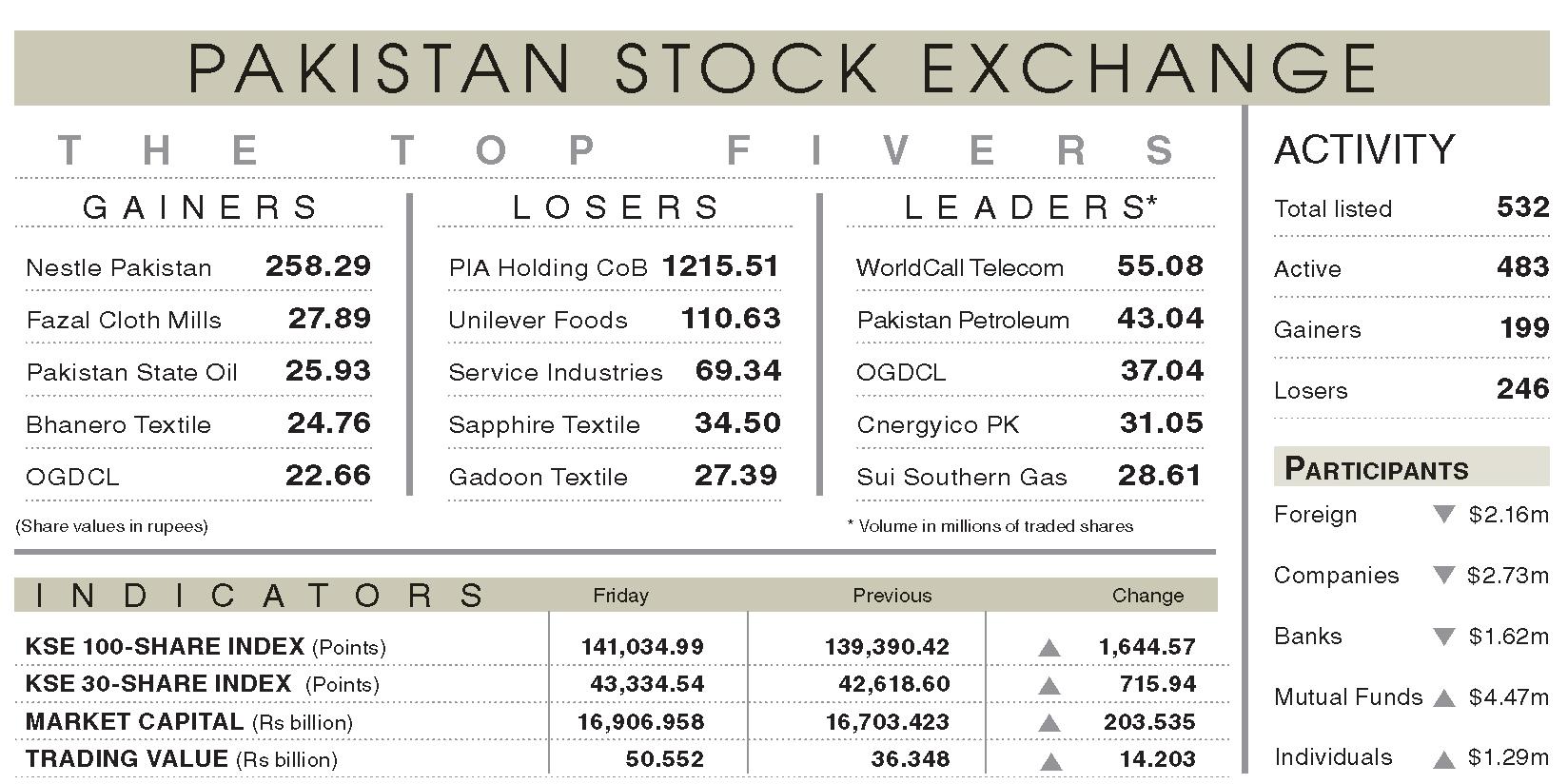

According to Topline Securities Ltd, the index climbed 1.18pc to close at a record 141,035 points, marking a gain of 1,645 points. The bullish sentiment was driven by news that Pakistan had secured a major trade breakthrough with the US, under which reciprocal tariffs would be slashed to 19pc from the previous 29pc, enhancing the country`s export competitiveness.

Adding to the momentum was speculation that the government may soon inject Rs1.25tr into thepower sector by borrowing from banks to clear circular debt arrears, a move widely seen as a stimulus for the energy sector.

Major positive contributions to the index -amounting to 1,355 points came from Oil and Gas Development Company Ltd, Pakistan Petroleum Ltd, Hub Power Company, and Pakistan State Oil.

These entities are expected to benefitdirectly from the anticipated debt payments.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, noted that the 140,000 barrier was decisively overcome due to a strong rally in energy stocks, bol-stered by prospects of US-Pakistan collaboration in oil exploration and impending circular debt resolution.

The PSX also showed resilience during intraday fluctuations, reboundingstrongly from the 138,000 level. Analysts said the 140,000 mark now serves as key support. If breached, the index could retreat towards 138,000, where attractive valuations and expectations of monetary easing may entice fresh buying.

Asad Mehanti of Arif Habib Corporation said the market closed near its peak as investors took cues from a favourable macroeconomic environment, including CPI inflation clocking in at 4.1pc year-on-year for July, a potential resolution of the circular debt through a Rs1.275tr restructuring plan, the US tariff deal, and recent cuts in fuel prices.

Market participation was robust, with trading volume rising 5.6pc to 609.7 million shares and traded value surging 39.07pc to Rs50.55bn.

WorldCallTelecomled the volumes chart with 55.8 million shares changing hands.