PSX extends record streak on strong buying

By Muhammad Kashif

2025-08-08

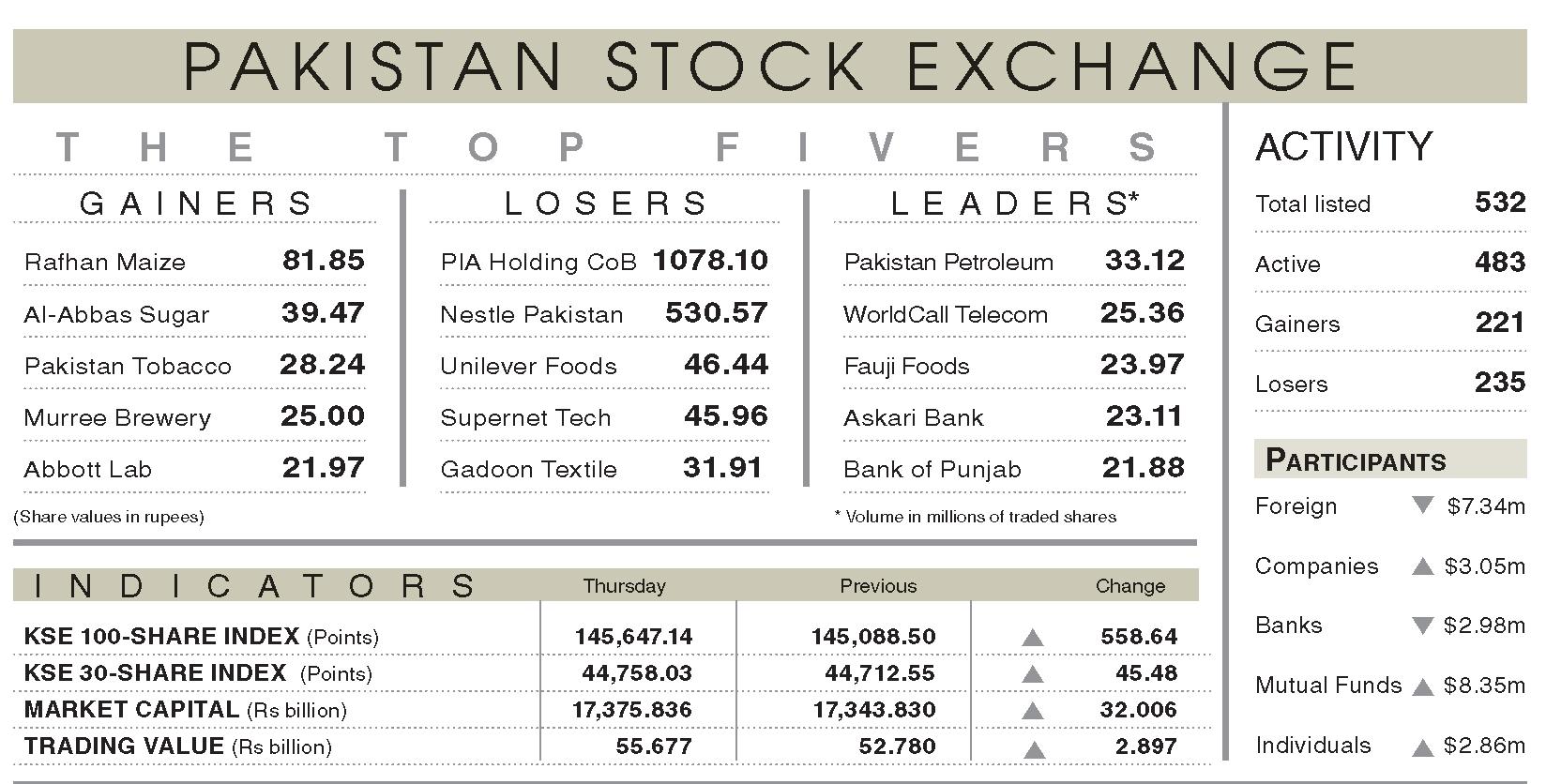

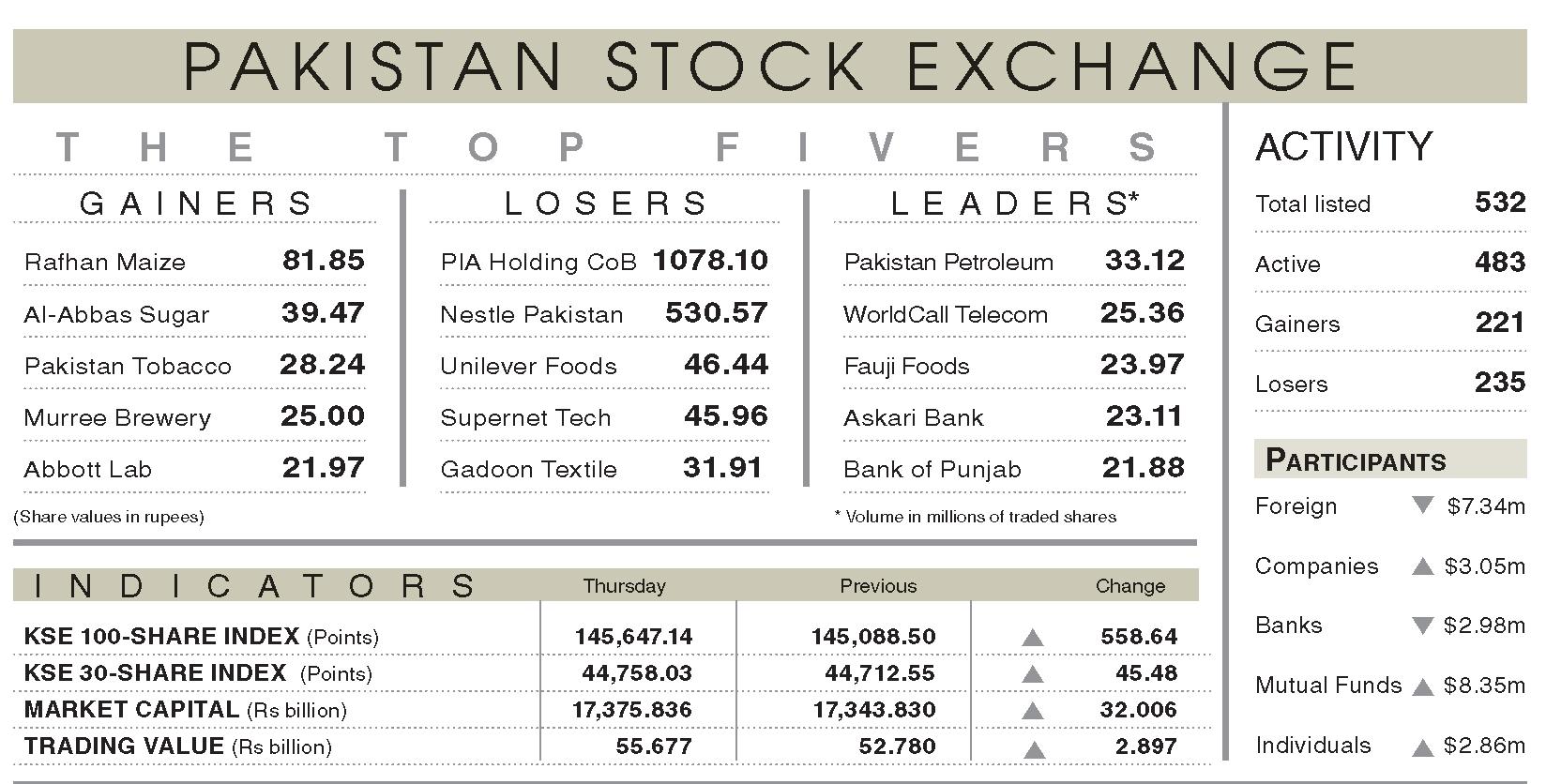

KARACHI: The Pakistan Stock Exchange (PSX) continued its record-setting rally on Thursday, marking its fifth consecutive session of gains. The benchmark KSE-100 Index breached the 146,000-point barrier intraday, buoyed by optimism carried over from previous sessions.

According to Topline Securities Ltd, the bullish momentum was sustained by strong institutional inflows, particularly from local mutual funds, as evidenced by data from the National Clearing Company of Pakistan Ltd (NCCPL). The market saw the KSE-100 Index surge by 993 points at one point, before closing at an alltime high of 145,647, reflecting a net gain of 559 points.

The rally was driven by index-heavyweights, including Pakistan Petroleum Ltd, Habib Bank Ltd, Engro Fertiliser, Systems Ltd, and Oil and GasDevelopment Company, which collectively contributed 738 points to the index`s upward movement.

Ahsan Mehanti of Arif Habib Corporation attributed the market`s record close to investor optimism, driven by a 17pc year-on-year increase inexports for July, along with the stability of the Pakistani rupee, rising global crude oil prices, buoyant global equities, and the expected positive outcome of the US-Pakistan tariff deal.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, noted that afterbreaching the historic 145,000-point mark in the previous session, the KSE100 Index took a brief pause, closing at 145,647, up 559 points or 0.39pc.

On the macroeconomic front, the Pakistan Bureau of Statistics (PBS) reported a trade deficit of $2.8bn in July. Exportsrose by 16.9pc year-onyear to $2.7bn, while imports increased by 29.2pc year-on-year to $5.4bn. These figures suggest a potential current account dencit of $125130 million at the start of FY26.

In the latest Treasury Bill (T-Bill) auction, theState Bank of Pakistan (SBP) raised Rs386.1bn against a target of Rs400bn, with total participation reaching Rs1,594.2bn. Yields rose by 5-30 basis points across all tenors.

Investors displayed a cautious stance during the session, engaging in sector rotation and selective profit-taking in light of the ongoing macroeconomic developments.

Looking ahead, analysts caution that some consolidation or correction may occur. In the event of a pullback, the 145,000-point mark is expected to act as the first support level, followed by 143,000. On the upside, the 150,000-point level remains a key resistance to watch.

Market participation declined, with trading volume falling by 9.63pc to 712.52 million shares.

However, the traded value saw an increase of 5.48pc, reaching Rs55.67bn.

Pakistan Petroleum led the volume chart with 33.12 million shares traded.