PSX ends flat as inflation concerns weigh

By Muhammad Kashif

2025-09-18

KARACHI: The Pakistan Stock Exchange (PSX) saw a volatile session on Wednesday, with the benchmark KSE-100 index closing nearly flat as profit-taking towards the end of the day dragged it into negative territory. The index fluctuated in a wide range, reflecting the market`s response to ongoing economic concerns, particularly the impact of flood-related agricultural losses on inflation.

Inflation remained a key concern for investors, with thelatestdatafromTopline Research indicating that the Consumer Price Index (CPI) for September is expected to rise by 6.5-7pc year-on-year, up from 3pc in August and 6.93pc in the same month last year. On a month-on-month basis, inflation for September is projected at 3.1pc, the highest in 26 months. The surge is largely attributedto rising food prices, with supply-side disruptions caused by the recent floods exacerbating the situation.

The food segment, in particular, is expected to see an 8.75pc month-on-month increase, potentially marking the highestever MoM rise in this category. These inflationary pressures contributed to cautious sentiment in the market, prompting someinvestors to take profits after recent gains.

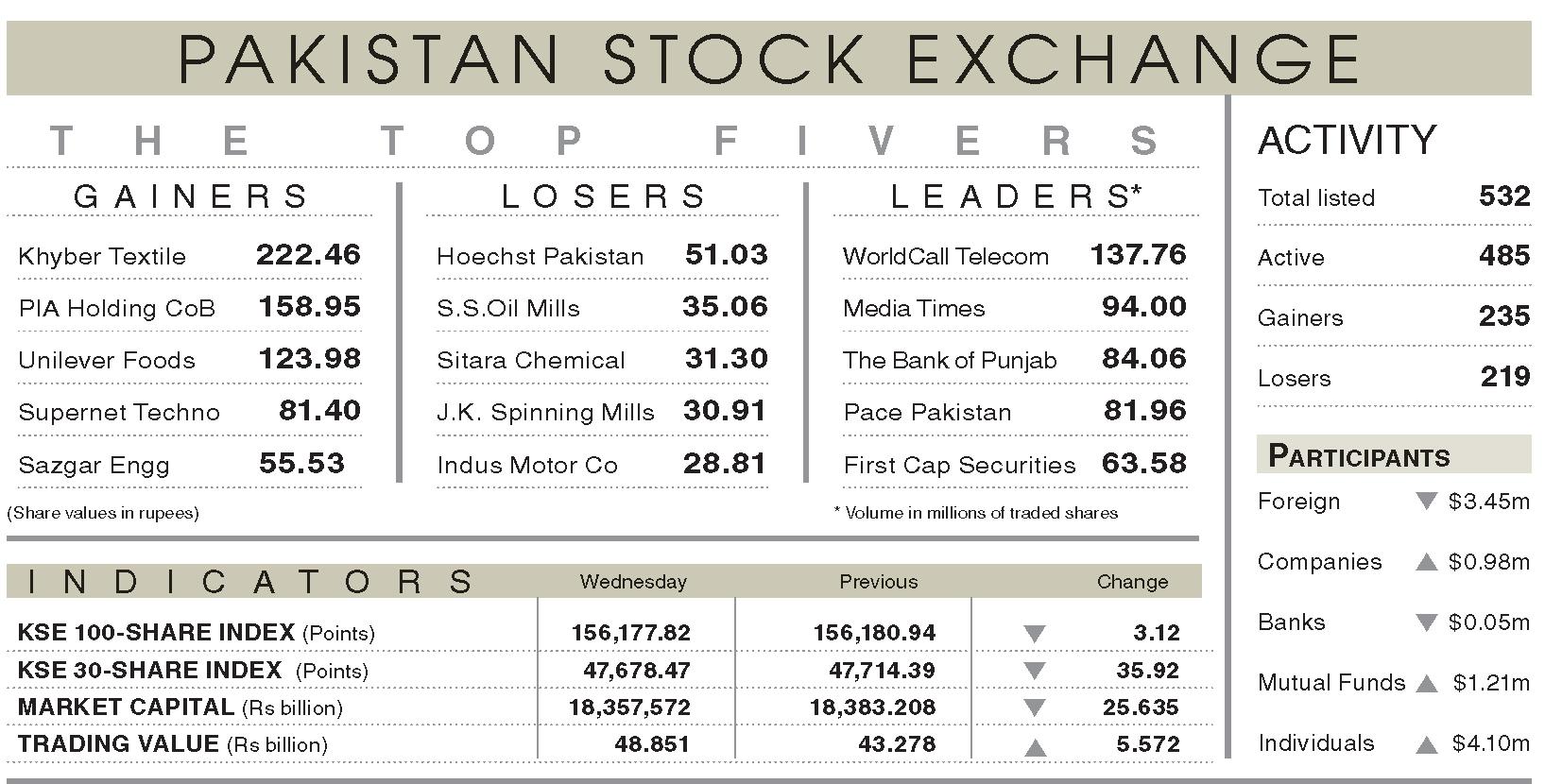

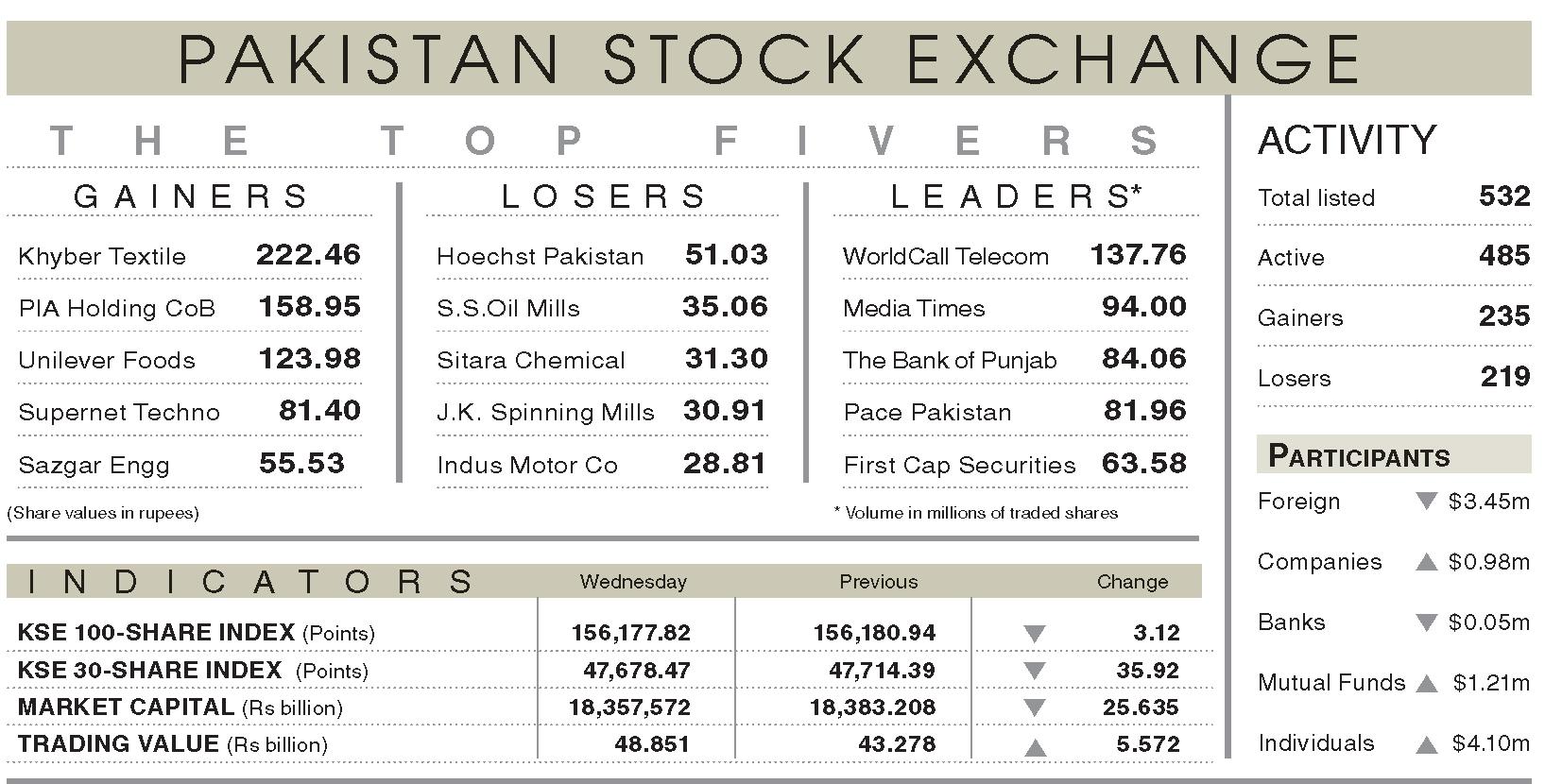

The KSE-100 index ended the day at 156,177.82, down by 3.12 points.

During the session, it touched an intraday highof 157,197 and a low of 155,960. Positive performances from stocks like Systems Ltd, Lucky Cement, and Bank of Punjab added 322 points to the index, but these gainswere offset by losses in companies such as Hub Power, Meezan Bank, Oil and Gas Development Company, Pakistan Petroleum, and United Bank, which collectively pulled the index down by 278 points.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, described the session as a `classic tug-of-war, with the index swinging within a narrow 1,236point range before ultimately closing almost unchanged.

Market liquidity improved, with trading volume rising by 10.56pc to 1.49bn shares, while the traded value increased by 12.87pc to Rs48.8bn. WorldCall Telecom remained the top traded stock, with 137.7m shares exchanged.Looking ahead, analysts expect the market to consolidate within the range of 155,000 to 158,000 points, with 154,000 serving as a potentialsupportlevelin case of profit-taking dips.