PSX scales another milestone of 148,000

By Muhammad Kashif

2025-08-19

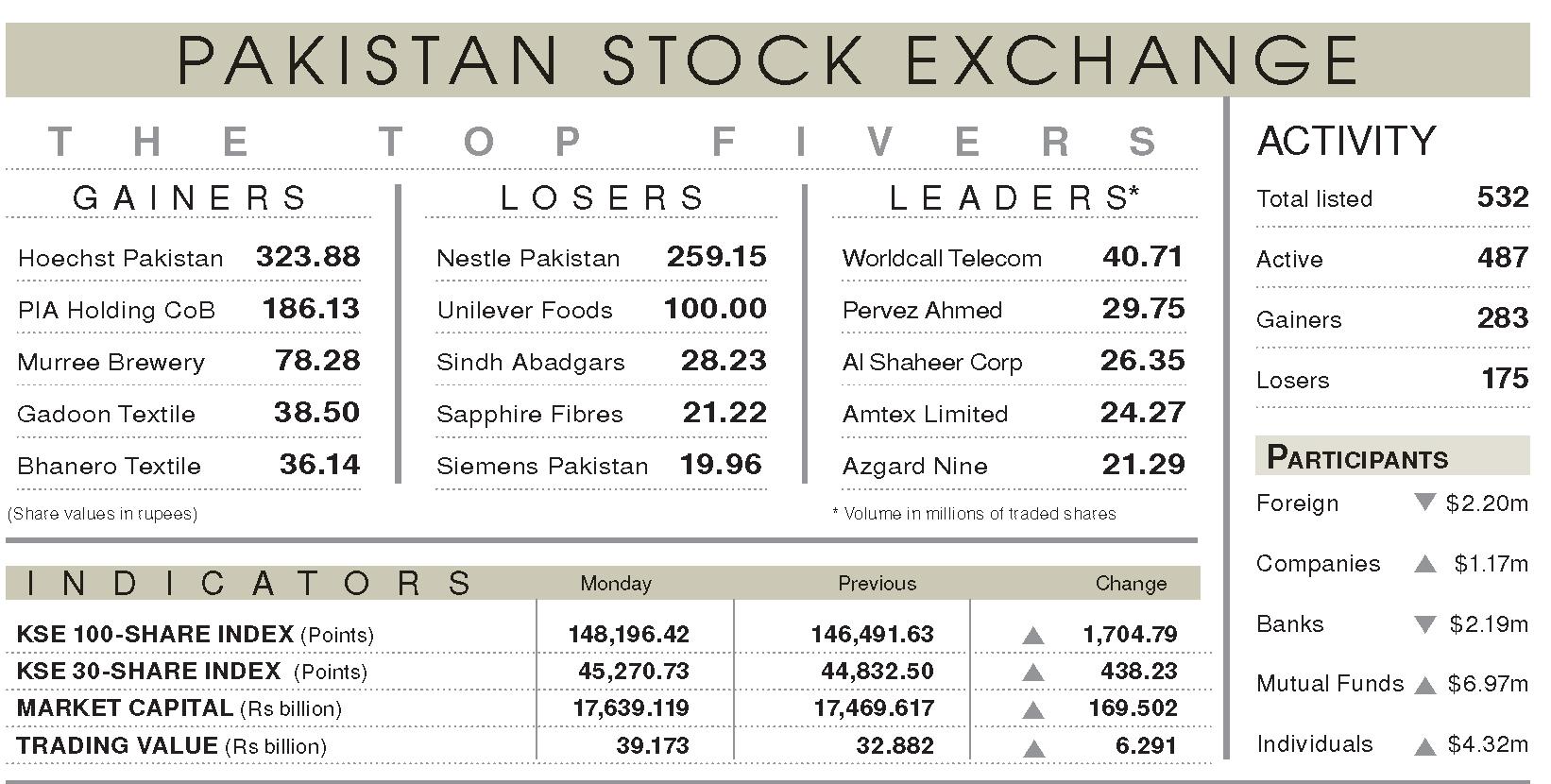

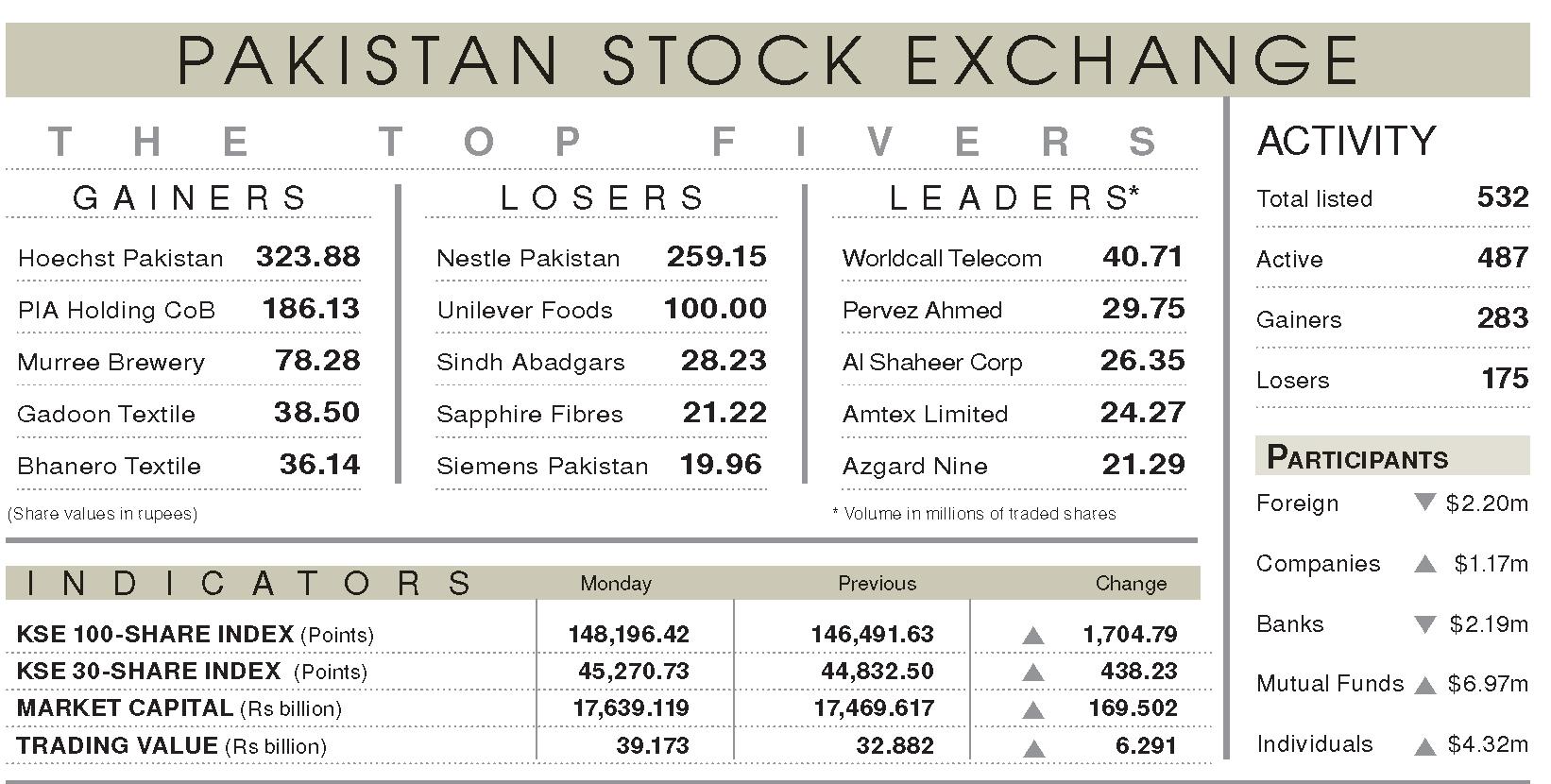

KARACHI: The Pakistan Stock Exchange (PSX) soared to an alltime high on Monday, with the benchmark KSE-100 index surging 1,704 points, or1.16 per cent, to close at 148,196.42 its highest level in history driven by renewed investor confidence amid credit rating upgrades, strong corporate earnings outlook, and anticipated economic reforms.

Market optimism was fuelled by Fitch Ratings` improved outlook on Pakistan`s banking sector and Moody`s upgrade of the country`s currency rating to Caal. Analysts noted growing investor appetite on expectations of macroeconomic stability, supported by a stable rupee, strong earnings potential, and speculation surrounding prospective US-Pakistan trade and investment engagements.

According to Topline Securities Ltd, the rally gained further momentum from reports of thegovernment`s circular debt reform plan. The proposed measures include reducing LNG cargoes, revising RLNG pricing, and mobilising funds through LNG diversion savings, state-owned enterprise (SOE) dividends, and power sector receivables. Detailed pro-posals are expected to be unveiled next week, sustaining bullish sentiment.

Ahsan Mehanti of Arif Habib Corporation said the market reacted positively to both domestic and international developments, pushing many stocks to new all-time highs. Key contributors tothe index included Lucky Cement, Meezan Bank, Bank Al-Habib, and Pakistan Petroleum, which collectively added 756 points to the day`s gains.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, said the market opened the week on a strong note, maintainingits northbound trajectory with sustained buying in heavyweight sectors.

Banking stocks particularly Meezan Bank, Bank Al-Habib, United Bank, and Bank Alfalah collectively contributed 619 pointstotheindexfollowing Fitch`s sectoral outlook, which cited imp-roving macroeconomic conditions, structural reforms, and stronger capital buffers. However, the agency also highlighted lingering risks, including sovereign health, inflation, and banks` exposure to public-sector clients.

Reports also indicated that the government may reduce LNG imports to two cargoes per month, down from the current 3-4, as part of efforts to curtail gas-sector circular debt and enhance fiscal sustainability.

Total traded volume rose 28.86pc to 610.3 million shares, while traded value increased by 19.13pc to Rs39.17bn. WorldCall Telecom (WTL) led the volume chart with 40.7 million shares traded.

Analysts believe progress on circular debt reforms may help sustain the market`s bullish momentum, although some consolidation or mild correction cannot be ruled out. Key support levels are now seen at 147,000 and 146,000 points, with resistance expected around the 150,000 mark.