Stocks stage 387-point rally on falling oil prices

By Our Staff Reporter

2022-10-20

KARACHI: The Pakistan Stock Exchange witnessed a bullish trend on Wednesday as investors welcomed lower international oil prices.

Topline Securities said a statement from the US Department of State clarifying that the United States is confident of Pakistan`s ability to keep its nuclear assets safe and secure also helped the index close on a bullish note.

The index traded in the green zone throughout the trading session as the trade deficit witnessed a decline of 30.2pc on a year-on-year basis, noted Arif Habib Ltd.

Investors` participation remained high in mainboard stocks while thirdtier stocks also attracted large volumes.

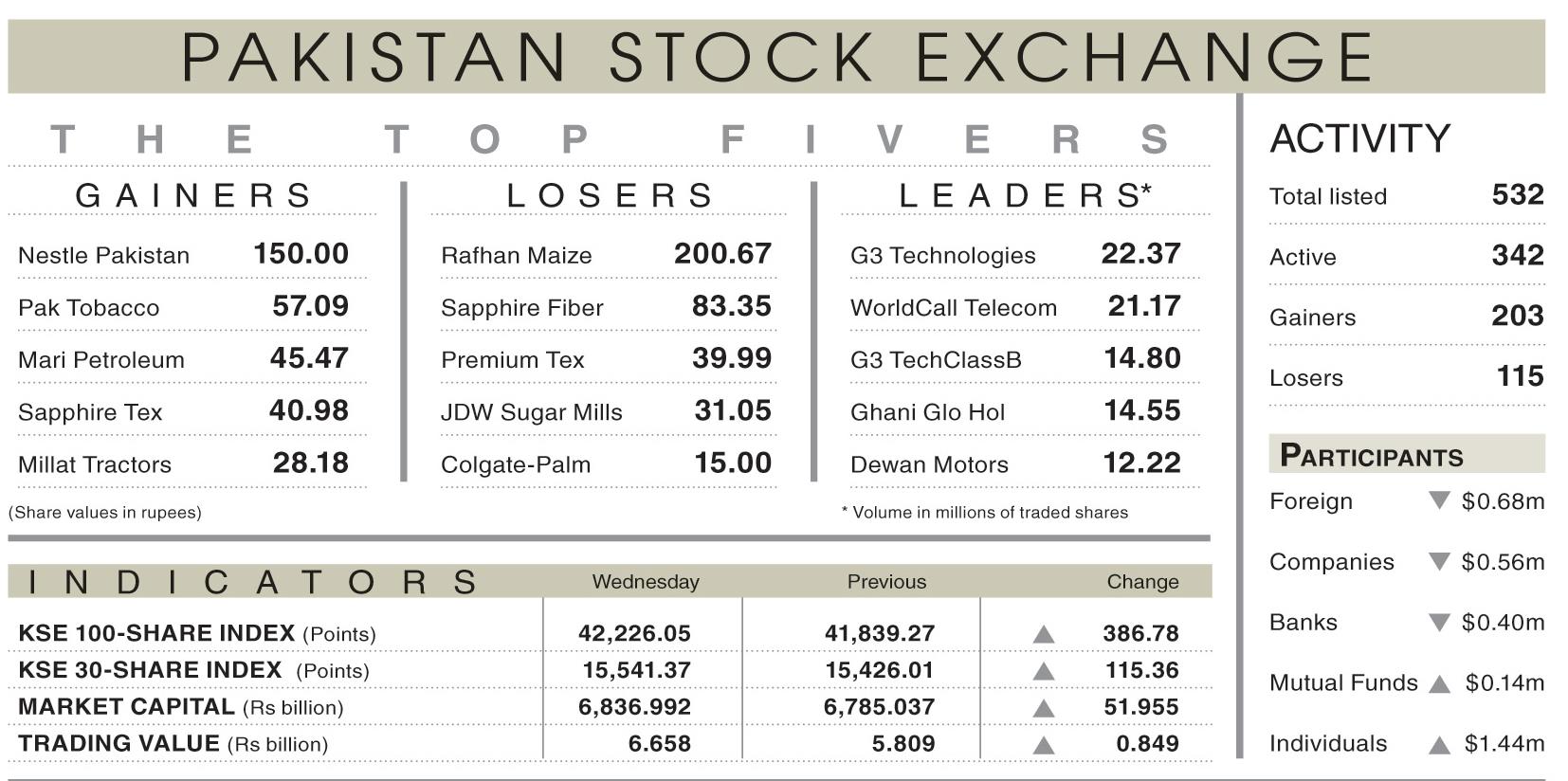

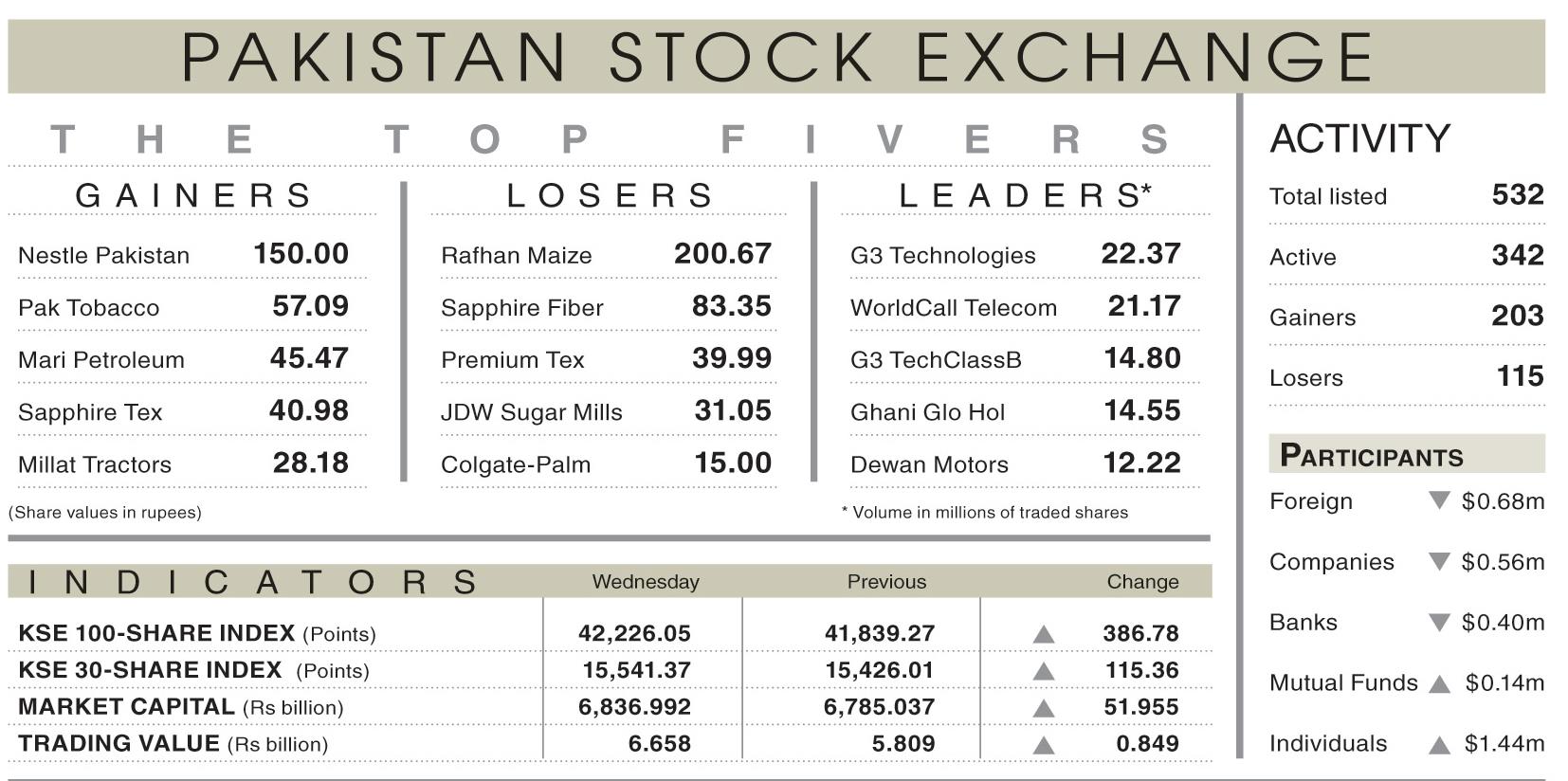

As a result, the KSE-100 index settled at 42,226.05 points, up 386.78 points or 0.92pc from the preced-KARACHI: The Pakistan Stock Exchange witnessed a bullish trend on Wednesday as investors welcomed lower international oil prices.

Topline Securities said a statement from the US Department of State clarifying that the United States is confident of Pakistan`s ability to keep its nuclear assets safe and secure also helped the index close on a bullish note.

The index traded in the green zone throughout the trading session as the trade deficit witnessed a decline of 30.2pc on a year-on-year basis, noted Arif Habib Ltd.

Investors` participation remained high in mainboard stocks while thirdtier stocks also attracted large volumes.

As a result, the KSE-100 index settled at 42,226.05 points, up 386.78 points or 0.92pc from the preced-ing session.

The trading volume increased 31.5pc to 250.3 million shares while the traded value went up 14pcto $30.1m on a day-on-day basis.

Stocks contributing significantly to the traded volume included G3 Tech-nologies Ltd (22.37m shares), WorldCall Telecom Ltd (21.17m shares), G3 Technologies Ltd-Class B (14.8m shares), GhaniGlobal Holdings Ltd (14.5m shares) and Dewan Motors Ltd (12.2m shares).

Sectors that contributed to the index performancewere commercial banking (67.6 points), cement (67.3 points), exploration and production (64 points), fertiliser (58.3 points) and automobile assembling (32.7 points).

Companies registering the biggest increase in their share prices in absolute terms were Nestle Pakistan Ltd (Rs150), Pakistan Tobacco Company Ltd (Rs57.09), Mari Petroleum Company Ltd (Rs45.47), Sapphire Textile Mills Ltd (Rs40.98) and Millat Tractors Ltd (Rs28.18).

Shares that declined the most in rupee terms were Rafhan Maize Products Company Ltd (Rs200.67), Sapphire Fibres Ltd (Rs83.35), Premium Textile Mills Ltd (Rs39.99), JDW Sugar Mills Ltd (Rs31.05) and Colgate-Palmolive Pakistan Ltd (Rs15).

Foreign investors remained net sellers as they offloaded shares worth $0.68m.