18pc tax levied on cotton imports

By Amjad Mahmood

2025-07-30

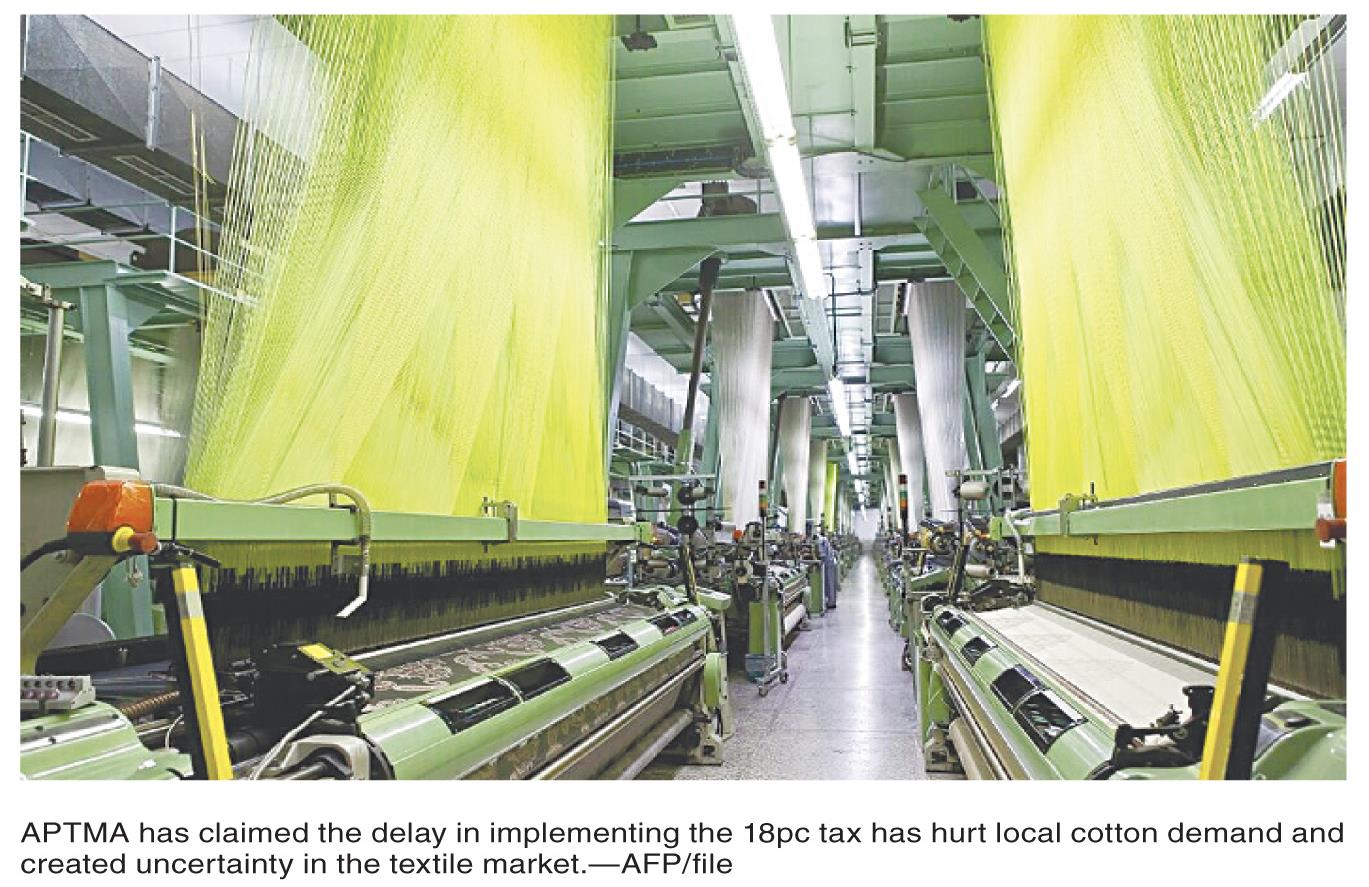

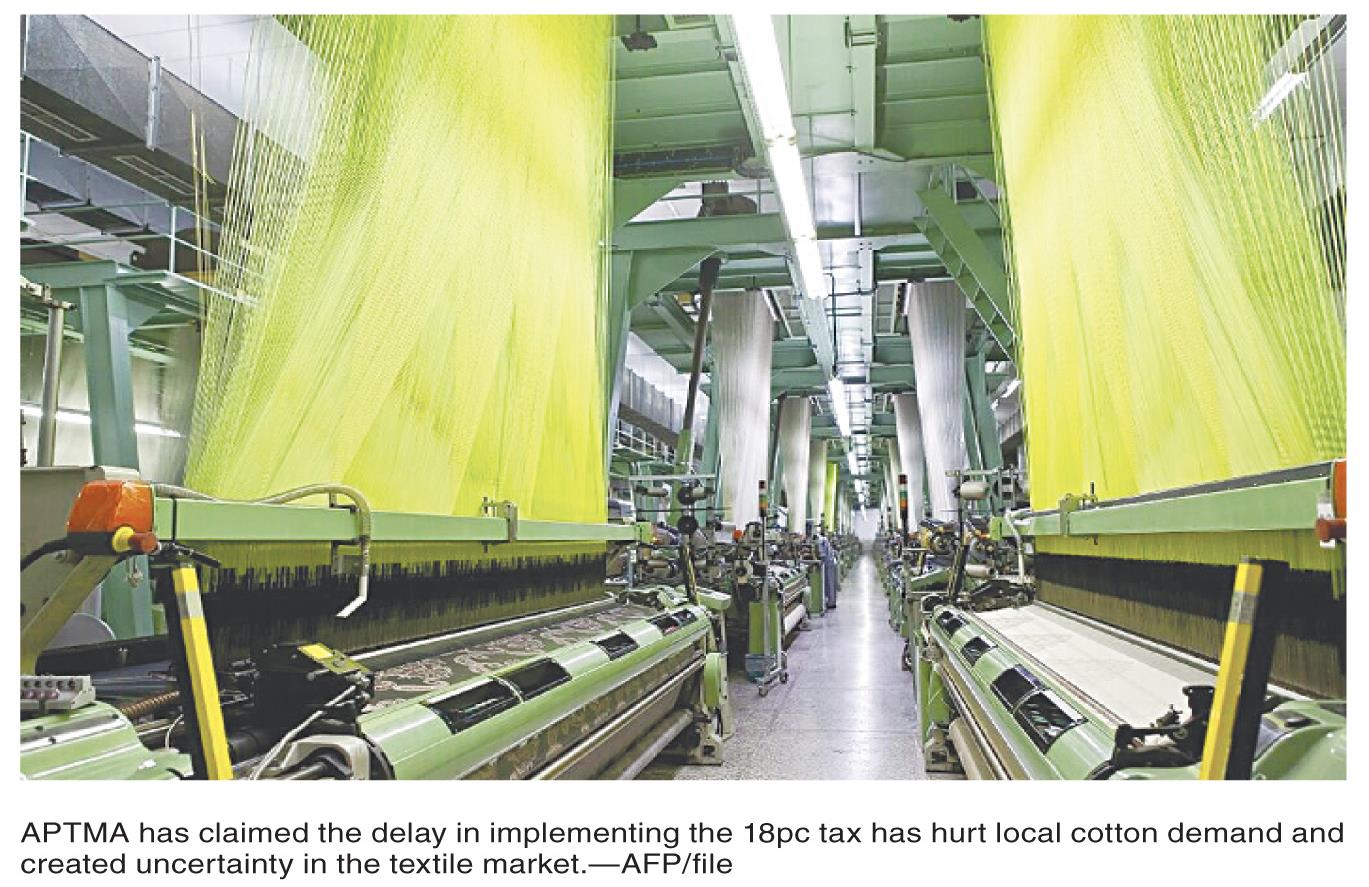

LAHORE: The Federal Board of Revenue (FBR) on Tuesday issued the much-delayed Statutory Regulatory Order (SRO) imposing an 18 per cent sales tax on the import of cotton fibre, yarn, and grey cloth, following sustained pressure from the All Pakistan Textile Mills Association (Aptma).

The tax measure, which aligns with commitments made in the federal budget for 2025-26, comes nearly a month after the budget announcement and over three weeks after formal cabinet approval. The delay, industry stakeholders say, has created uncertainty in the market and hurt domestic cotton producers.

The SRO 1359(I)/2025 stipulates that `[r] aw cotton, cotton yarn and grey cloth falling under the respective headings of Pakistan Customs Tariffs shall be excluded from the scope of the Export Facilitation Scheme (EFS).` However, it exempts import consignments with bills of lading dated within 10 days ofthe notincation.

Aptma had repeatedly urged Finance Minister Muhammad Aurangzeb to issue the notification without further delay, emphasising that implementation of the 18pc sales tax was critical to correcting the tax disparity between imported and domestic inputs.

In a letter dated July 18, Aptma Chairman Kamran Arshad reminded the government that the budget clearly outlined the inclusion of these imports in the 18pc tax bracket, while still retaining them under the EFS. Though the association initially called for their complete exclusion from the scheme, the government instead opted to equalise the tax treatment of local and imported inputs used forexports, rather than removing the imports from the facilitation scheme altogether.

The delay in issuing the SRO, despite cabinet approval and a July 15 implementation date set by a committee led by Deputy Prime Minister Ishaq Dar, drew criticism from Aptma.

The association warned that the delay had coincided with the arrival of Pakistan`s new cotton crop, which now faces weal( demand due to prevailing market ambiguity. With traders and mills hesitant to make purchasesamid the policy vacuum, Aptma said the domestic cotton and yarn sectors were at risk.

Pakistan`s textile sector, which accounts for over 50pc of the country`s total exports, posted a $1.5bn increase in export earnings in 2024-25. However, this was of fset by a $1.52bn surge in imports, resulting in a net negative impact on the country`s balance of payments. Aptma maintains that such distortions can only be corrected through consistent and timely implementation of trade and tax policies.